The year 2025 is a landmark year for commercial solar solutions in India. Driven by rising industrial and commercial (C&I) electricity tariffs, state and central government incentives (like Accelerated Depreciation, and the overall push for ALMM compliance), and a strong commitment to sustainability, investing in a commercial photovoltaic (PV) system is now a crucial financial decision. For business owners, financial controllers, and Chief Financial Officers (CFOs), the core question remains: How do commercial solar solutions translate into a measurable Return on Investment (ROI) in the Indian context?

This comprehensive cost-benefit analysis breaks down the financial components, operational advantages, and strategic value of installing commercial solar panels, providing a clear roadmap for maximizing your returns in the Indian market.

The Financial Case: Calculating the True Cost and ROI in India

A successful commercial solar project in India starts with a rigorous financial assessment that accounts for local costs, tax benefits, and net metering policies.

1. Cost Side: Initial Investment and Operational Expenses

The initial investment for a commercial solar solution (e.g., rooftop or ground-mounted) typically includes the cost of solar modules, inverters, structures, and installation. In 2025, commercial systems in India generally cost between ₹35,000 to ₹50,000 per kilowatt-peak (kWp). The final cost is highly variable based on the scale of the project, the quality of equipment used (ALMM-compliant vs. non-compliant), and the location.

| Cost Component | Description | Financial Impact |

| Equipment & Modules | ALMM-compliant solar modules, string/central inverters, and mounting structures. | High Upfront Cost. High-quality, reliable equipment ensures higher energy output over the long term. |

| Installation & Labor | Engineering, design, government approvals, and professional installation services. | Varies according to project complexity (roof type, height) and state-specific labor rates. |

| Ongoing O&M (Operation & Maintenance) | Routine cleaning, monitoring subscriptions, and inverter replacement (typically once every 10-15 years). | Low Annual Cost (generally 1-2% of initial investment), but critical for high efficiency. |

| Financing Costs | Interest rates on solar loans or fees associated with a Power Purchase Agreement (PPA). | Can be structured to make the project feasible with minimal capital expenditure (CapEx). |

2. Benefit Side: Savings, Tax Advantages, and Incentives

The financial benefits of commercial solar solutions are substantial and accrue over the system’s 25 to 30-year lifespan.

- Utility Bill Reduction: This is the most significant and immediate benefit. Solar power offsets your expensive Industrial or Commercial (C&I) tariff electricity, which can reduce your monthly electricity bill by 30% to 70%.

- Net Metering / Gross Metering: Policies vary by state, but typically, surplus electricity exported to the grid earns you credit or payment, accelerating the savings and payback.

- Government and Tax Incentives:

- Accelerated Depreciation (AD): Indian tax law permits a high rate of depreciation (e.g., 40%) on C&I solar projects in the first year. This significantly reduces your taxable income, resulting in substantial tax savings and a much shorter Payback Period.

- Subsidies: While large-scale commercial/industrial subsidies are limited, the AD benefit is often the biggest financial driver for the C&I sector.

Table 1: Commercial Solar ROI Calculation (Hypothetical Indian Example)

This table illustrates the strong financial case for a typical mid-sized commercial solar installation (e.g., 100 kWp) in India.

| Metric | Calculation / Estimate | Financial Outcome |

| System Size | 100 kWp | Initial Cost (at ₹40,000/kWp): ₹40,00,000 |

| Annual Energy Generation | 1,50,000 kWh | Annual Energy Savings: ₹15,00,000 (assuming C&I tariff of ₹10/kWh) |

| Net Cost After AD Benefit | Initial Cost – Accelerated Depreciation Tax Savings | ₹28,00,000 to ₹32,00,000 |

| Payback Period | Net Cost / Annual Savings | 2.5 to 4 years |

| 25-Year ROI | (Total Lifetime Savings – Net Cost) / Net Cost | 300% to 500% |

| Annual Return | Average annual return after payback period. | 20% to 35% (Increases as utility rates rise) |

Operational & Strategic Benefits of Commercial Solar Solutions

The value of commercial solar solutions extends beyond direct financial metrics to provide crucial operational stability and long-term strategic advantages.

1. Energy Security and Price Hedging

C&I electricity tariffs in India are volatile and increasing. By generating your own power, you effectively fix your energy costs for the next 25+ years. This hedges your business against unpredictable utility rate hikes and allows for accurate long-term budgeting.

- Protection from Power Cuts: A solar system integrated with a Battery Energy Storage System (BESS) provides essential backup power during grid outages. This is vital for manufacturing units, data centres, and critical infrastructure, preventing expensive downtime and production losses.

2. Boosting Property Value and Asset Creation

Unlike paying monthly utility bills, which is essentially renting power, purchasing a commercial solar system creates a tangible, income-generating asset.

- Increased Property Value: Commercial properties with existing solar installations have a higher appraisal value and faster leasing rates, as the new owner/tenant inherits guaranteed lower operating costs.

- Excellent Bankability: Financial institutions often view solar energy projects as “Green Assets” and offer concessional loan terms, strengthening your company’s financial profile.

3. Corporate Sustainability and Brand Image

In the modern business landscape, sustainability is a competitive differentiator. Commercial solar solutions directly address Environmental, Social, and Governance (ESG) criteria.

- Carbon Footprint Reduction: Transitioning to solar is the most effective way to dramatically reduce your business’s carbon emissions and meet corporate sustainability targets.

- Enhanced Brand Reputation: Consumers, investors, and B2B partners increasingly prefer working with eco-conscious companies. A visible solar installation serves as a powerful marketing tool, enhancing brand reputation and attracting ESG-focused investment.

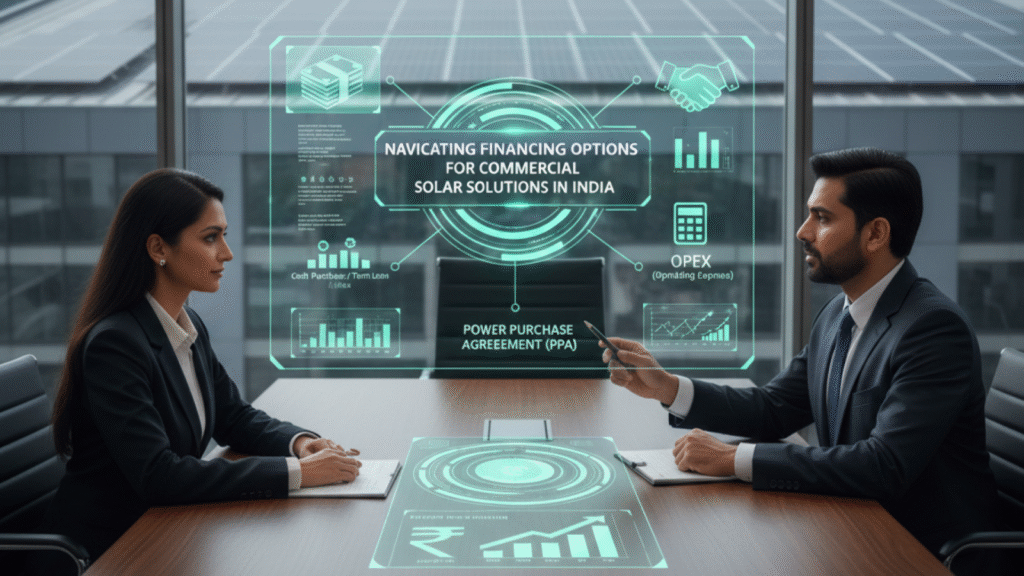

Navigating Financing Options for Commercial Solar Solutions in India

The Indian market offers diverse financing models that allow businesses to adopt solar with minimal or zero initial investment.

Table 2: Comparative Commercial Solar Financing Models in India

| Financing Model | Ownership | Upfront Cost | Key Benefit | Ideal For |

| Cash Purchase / Term Loan | Business | High (Cash) / Low (Loan) | Access to all tax incentives (Accelerated Depreciation) and highest long-term ROI. | Businesses with high tax liability and access to capital. |

| Power Purchase Agreement (PPA) | Third-Party Developer | Zero | The business buys solar electricity at a discounted, fixed rate lower than the utility tariff. | Businesses with low/no tax liability or those seeking zero CapEx. |

| OPEX (Operating Expense) | Third-Party Developer | Low/Zero | Fixed monthly payment for the system; the developer handles maintenance. | Businesses aiming to avoid CapEx and prefer to treat solar as a predictable OpEx. |

Choosing the right financing model is crucial for optimizing the financial return. An experienced commercial solar solutions provider will perform a tailored assessment to recommend the best option based on your business’s tax appetite and cash flow goals.

Key Considerations for a Successful Commercial Solar Solution Project

To ensure your investment delivers the expected high ROI, consider these critical factors:

- Site Suitability and Structural Integrity: A thorough structural assessment is mandatory. The roof space, orientation (ideally South-facing), and structural load capacity must be confirmed. Ground-mounted solutions are a viable alternative if the rooftop is insufficient.

- System Design and ALMM Compliance: The system must be optimally sized to match your business’s specific energy usage profile, particularly peak usage hours. Using ALMM (Approved List of Models and Manufacturers)-compliant panels is increasingly important in India to ensure quality, reliability, and eligibility for certain financial schemes.

- Installer Experience and Warranty: The quality of installation directly affects system performance and longevity. Choose an installer with a proven track record in commercial solar solutions and ensure the contract includes comprehensive warranties (25 years for performance, 10-12 years for equipment) and a robust Operations & Maintenance (O&M) plan.

- Future-Proofing: Design the system to accommodate potential future expansion. Given the rise of electric vehicle (EV) fleets and increased industrial automation, energy demands are likely to grow. A modular design can save costs later.

Conclusion: The Strategic Imperative of Commercial Solar Solutions in India

The ultimate cost-benefit analysis of commercial solar panels in 2025 is overwhelmingly positive. While the upfront investment requires careful planning, the combination of immediate energy cost savings, powerful tax benefits like Accelerated Depreciation, long-term energy price stability, and enhanced brand equity positions commercial solar as a superior financial asset.For any forward-thinking business, adopting commercial solar solutions is no longer a luxury—it is a strategic decision that drives profitability, mitigates risk, and secures a competitive edge in a rapidly evolving energy market.

Frequently Asked Questions (FAQs) about Commercial Solar Solutions in India

Q1: What is the average payback period for a commercial solar system in India?

A: The average payback period for a commercial solar solution is typically between 2.5 to 5 years, driven down by the high C&I tariffs and the benefit of Accelerated Depreciation (AD).

Q2: Is there a significant government subsidy available for commercial solar systems in India?

A: Subsidies in India are mainly focused on the residential sector. The commercial and industrial (C&I) sectors should primarily focus on tax benefits such as Accelerated Depreciation (AD) and potentially concessional loans, which are the main financial drivers for ROI in this segment.

Q3: What is the significance of ALMM-Compliance?

A: ALMM (Approved List of Models and Manufacturers) is a list of approved models mandated by the Indian government. Using ALMM-compliant panels is important as it ensures quality and reliability, and is often a prerequisite for obtaining financing from banks and participating in certain state-level schemes.

Q4: What happens to the solar electricity if the grid goes down?

A: Standard grid-tied commercial solar systems are required to shut down during a grid outage for the safety of utility workers. However, if you install a solar battery storage solution, your business can continue to run critical operations using the stored solar power, providing essential energy continuity.