The global energy transition is not merely an environmental trend; it’s a smart financial decision. Businesses and homeowners can now realize substantial returns from clean power. This article demonstrates how switching to green sources unlocks the genuine, long-term economic benefits of renewable energy, establishing a foundation for sustainable prosperity. We move beyond simple savings to explore how clean power drives national security, employment growth, and unparalleled financial stability.

Unlocking Immediate Financial Benefits of Renewable Energy

The most compelling advantage of switching to clean power is the drastic reduction in operational spending, positioning renewable systems as powerful financial assets.

Cost Stability and Zero Fuel Costs

Unlike volatile fossil fuels, which require continuous purchasing, solar, wind, and hydro are free resources. Consequently, once a renewable system is installed, your electricity generation cost drops almost to zero. This zero-fuel nature provides an absolute hedge against market volatility, ensuring predictable long-term budgets. Traditional energy markets fluctuate violently due to geopolitical events, shipping costs, and supply chain disruptions. In stark contrast, a solar array on your roof or a corporate power purchase agreement (PPA) locks in your energy cost for decades.

Furthermore, the Levelized Cost of Electricity (LCOE) for new renewable projects is consistently lower than that of new fossil fuel plants. LCOE calculates the total lifetime cost of a power source. With the declining cost of renewable technology and rising carbon pricing, analysts routinely find that building new solar and wind farms is cheaper than operating existing fossil fuel plants. Thus, the financial case for decommissioning old, costly fossil assets and replacing them with modern, zero-fuel renewables is overwhelmingly strong.

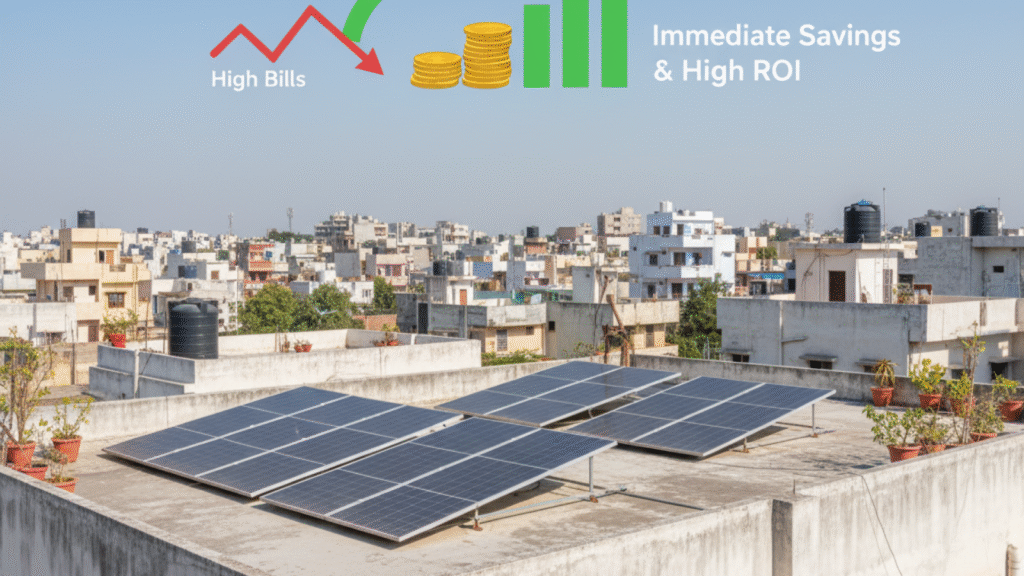

High ROI from Incentives and Value Generation

Initial investment should not be a deterrent. Governments offer generous financial incentives, such as tax credits and capital rebates, that significantly reduce the upfront cost. Thus, these incentives dramatically boost your system’s Return on Investment (ROI).

Moreover, generating surplus energy allows owners to earn revenue through Net Metering or by selling Renewable Energy Certificates (RECs). This dual benefit accelerates the payback period. Net metering provides direct credits on your utility bill when your system produces more than you consume. RECs, on the other hand, are market commodities that companies purchase to meet sustainability targets, adding a valuable secondary revenue stream. These financial mechanisms effectively transform a cost center (your electricity bill) into a profit-generating asset.

Broader Economic Impact and Security: Driving Macroeconomic Growth

The financial advantages extend far beyond utility bill savings to affect the wider economy and national security, making this transition a critical national strategy.

Job Creation and Sustainable Economic Growth

The renewable sector is a powerful engine for job creation. It employs millions globally in manufacturing, installation, and maintenance—jobs that are typically local, highly skilled, and high-growth. Data shows that the renewable sector creates up to three times more jobs per million dollars invested compared to the fossil fuel industry.

Therefore, investing in green power stimulates domestic economic activity, fostering regional supply chains and skill development in emerging technologies. This investment creates a workforce prepared for the economy of the future, supporting long-term stability rather than volatile boom-and-bust cycles. In essence, every green energy project is an investment in local employment and economic self-sufficiency.

Enhanced Energy Security: A Crucial Economic Benefit of Green Energy

A move to renewable energy enhances energy independence. By decentralizing power generation and utilizing abundant domestic resources (sun, wind, water), countries and corporations reduce their reliance on foreign fuel imports. This shift provides greater security and resilience against geopolitical risks, international conflicts, and grid failures.

For example, during periods of international instability, nations with high renewable penetration are largely shielded from global energy price spikes. Consequently, this stability protects consumers from crippling electricity bills and shields industries from costly operational interruptions, securing the nation’s economic backbone.

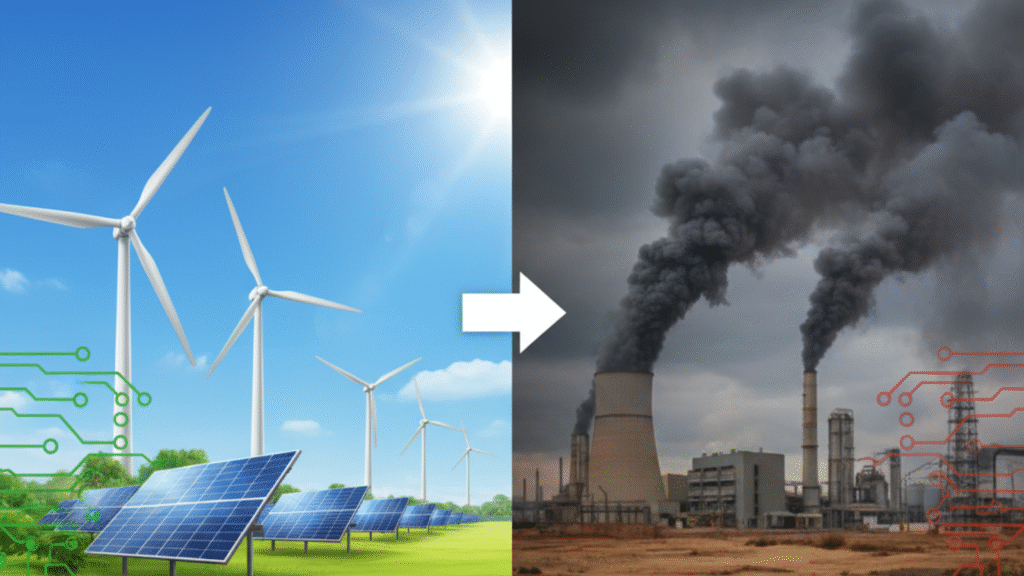

Hidden Economic Benefit: Reduced Public Health Costs

Traditional energy sources impose massive externalized costs on society, particularly through air pollution. Significantly, the economic damage from health-related illnesses (respiratory disease, cardiovascular issues) caused by burning fossil fuels amounts to billions of dollars annually in healthcare expenses and lost productivity. By choosing clean energy, we drastically reduce these pollutants. Therefore, the transition to renewables results in substantial public health savings, which are a crucial, yet often overlooked, long-term economic benefit.

Economic Benefits of Renewable Energy: Comparison Table (Green Power vs. Fossil Fuels)

This detailed table highlights the key economic benefits of renewable energy compared to traditional sources.

| Economic Factor | Renewable Energy (Green Power) | Fossil Fuels (Traditional) |

| Fuel Cost (Active: You eliminate this cost) | Zero (Sun, Wind are free) | High and Volatile |

| Price Predictability (Passive: Cost is guaranteed) | High (Cost is locked in for 25+ years) | Low (Subject to market fluctuation) |

| LCOE Trend | Steadily Decreasing due to innovation | Stagnant or Increasing due to scarcity/carbon tax |

| ROI (Active: You realize profits quickly) | Typically 2–6 years for payback, then pure profit | Negative (Continuous cost center) |

| Energy Security | High (Domestic, diversified, decentralized) | Low (Dependent on global supply chains) |

Frequently Asked Questions (FAQ) about the Economic Benefits of Renewable Energy

Q1: Does renewable energy offer a competitive ROI compared to other long-term investments?

A: Yes, the ROI is highly competitive. Despite the initial installation cost, generous government incentives (tax credits, depreciation) and zero fuel expenses drive the financial return. In fact, many commercial projects achieve full payback in under six years, after which the generated power costs virtually nothing, offering predictable returns far exceeding many conventional financial instruments.

Q2: How does the decentralization of green power affect economic resilience?

A: Decentralization means generating power closer to where it is consumed (e.g., rooftop solar). This system reduces reliance on long transmission lines, making the grid inherently more resilient to physical attacks, severe weather events, and localized failures. Consequently, the economic risk of large-scale power blackouts significantly decreases.

Q3: How does the sale of Renewable Energy Certificates (RECs) work financially?

A: When your system produces one MWh of electricity, it also creates one REC, representing the environmental credit. You can sell this REC to corporations that need to offset their carbon footprint. In addition, this creates an independent revenue stream that is separate from the income you receive from selling the physical electricity, maximizing your profit margin.

Q4: Are there financial risks associated with the lifespan and maintenance of renewable systems?

A: The risk is low. Modern solar panels and wind turbines are highly durable with lifespans exceeding 25 years. Warranties are standard, and routine maintenance is minimal, often accounting for only a small fraction of the avoided fuel costs. Thus, the financial benefits far outweigh the operational maintenance costs over the system’s lifetime.

Q5: How do renewable energy technologies drive broader technological innovation and competition?

A: The rapid growth in renewables fuels a virtuous cycle of innovation. Competition forces companies to constantly develop cheaper, more efficient panels, better batteries, and smarter grid software. This competition drives down the LCOE for everyone and leads to new export opportunities and patents, creating long-term economic advantages for countries that lead the charge.

Conclusion: Investing in the Future of Green Economics

The shift to renewable energy is no longer a conversation about “if,” but “how quickly” and “how profitably.” By eliminating volatile fuel costs, leveraging substantial government incentives, and creating high-quality domestic jobs, green power offers profound, self-reinforcing economic benefits.

Ultimately, businesses and governments that strategically invest in renewable energy today are actively building a future characterized by financial certainty, energy independence, and competitive advantage. The true Return on Investment (ROI) from clean power extends well beyond the balance sheet; it secures long-term economic security and public well-being for generations to come. The time to maximize the economic benefits of renewable energy is now.