Switching to solar energy is one of the best long-term investments a homeowner can make, offering significant savings on utility bills, a reduced carbon footprint, and increased property value. However, the initial upfront cost of a solar panel system can be substantial, often ranging from tens of thousands of dollars. This is where the crucial question arises: How to finance solar panels?

Fortunately, the solar industry has developed a variety of flexible financing solutions that make going solar accessible to almost every budget. This comprehensive guide breaks down all the primary ways you can pay for your home solar system, helping you find the perfect path to energy independence.

How to Finance Solar Panels: Understanding the Main Options

When considering how to finance solar panels, the options typically fall into two main categories: Ownership and Third-Party Ownership (TPO). Your choice dictates who receives the financial incentives, who is responsible for maintenance, and your overall long-term savings.

The Ownership Path: Cash Purchase and Solar Loans

The ownership model provides the highest long-term financial returns because you own the asset outright. This means you benefit from all incentives, increased home value, and utility savings immediately.

The Simplest Route: Paying with Cash

For homeowners with sufficient liquid capital, a direct cash purchase is the most financially advantageous way to go solar.

- Pros: Maximum lifetime savings (no interest payments), quickest return on investment (ROI), immediate eligibility for all tax credits and incentives (like the Federal Solar Investment Tax Credit—ITC), and maximum increase in home value.

- Cons: Requires the largest upfront capital expenditure, which can be prohibitive for many households.

The Most Popular Choice: Solar Loans

If you want the benefits of ownership but don’t want to pay the full cost upfront, a solar loan is likely the best answer to how to finance solar panels. A loan allows you to buy the system and pay the cost back over time, much like a mortgage or car loan.

Solar loans can be secured (using your home as collateral) or unsecured (a personal loan), with terms usually ranging from 5 to 25 years.

- Secured Solar Loans (Home Equity): Home Equity Loans (HEL) or Home Equity Lines of Credit (HELOCs) often offer the lowest interest rates because they are secured by your home. The interest may also be tax-deductible.

- Unsecured Solar Loans (Personal Loans): These are often offered by banks, credit unions, or specialized solar lenders. While interest rates may be slightly higher than secured loans, the application process is generally faster, and your home is not used as collateral.

- Property Assessed Clean Energy (PACE) Financing: Available in select areas, PACE allows you to finance the solar system through an assessment added to your property tax bill. This financing is tied to the property, not the owner, meaning the remaining balance often transfers to the new owner upon sale.

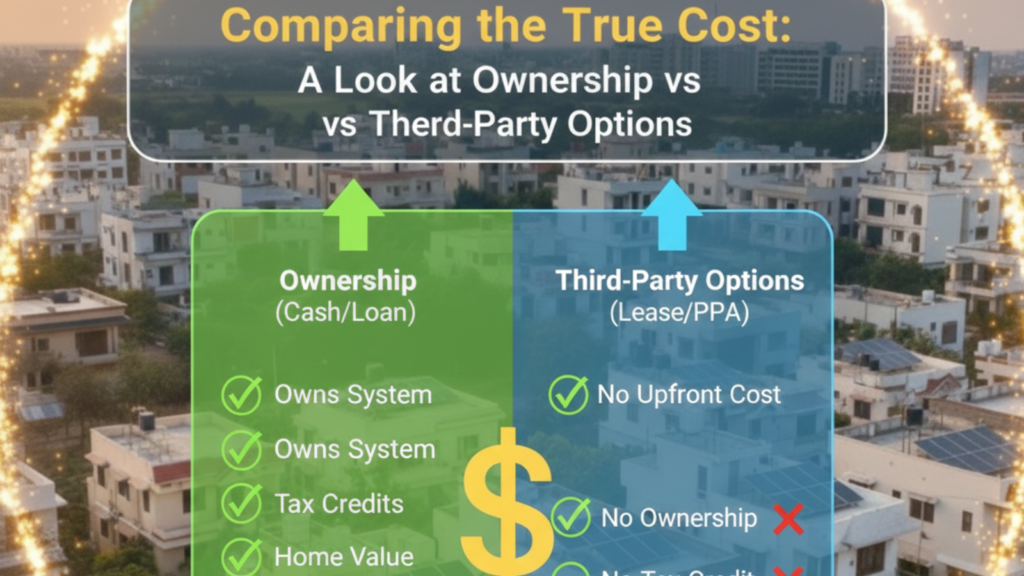

Comparing the True Cost: A Look at Ownership vs. Third-Party Options for Solar Panels

To fully determine how to finance solar panels, it’s essential to compare the financial outcomes of owning versus leasing/PPA. The difference in overall lifetime savings is significant.

| Financing Option | Upfront Cost | System Ownership | Eligible for Federal ITC (Tax Credit) | Lifetime Savings Potential (25-Year) | Impact on Home Sale |

| Cash Purchase | High (100%) | Homeowner | Yes (Claimed by you) | Highest | Positive increase in home value |

| Solar Loan | Low to Zero | Homeowner | Yes (Claimed by you) | High (Varies by interest rate) | Positive increase in home value |

| Solar Lease | Zero | Solar Provider | No (Claimed by provider) | Moderate | May complicate the sale (must transfer lease) |

| Power Purchase Agreement (PPA) | Zero | Solar Provider | No (Claimed by provider) | Moderate | May complicate the sale (must transfer PPA) |

Third-Party Ownership (TPO): Lease and PPA Explained

For homeowners who prioritize zero upfront cost above all else, Third-Party Ownership (TPO) models like Leases and Power Purchase Agreements (PPAs) are attractive. Under these models, a solar provider installs, owns, and maintains the system on your roof.

Solar Lease

In a solar lease, you essentially rent the solar equipment. You pay a fixed monthly fee to the provider for the right to use the system. Your electricity bills will decrease because you are using solar power, and the fixed lease payment replaces a portion of your previous utility bill.

- Pros: Zero upfront cost, all maintenance and repairs are covered by the provider, predictable monthly payment, and instant reduction in utility costs.

- Cons: You do not own the system, meaning you are not eligible for the ITC or other ownership-based incentives. Overall, lifetime savings are significantly lower than with a loan or cash purchase.

Power Purchase Agreement (PPA)

A PPA is similar to a lease, but instead of paying a fixed fee for the equipment, you agree to buy the electricity generated by the panels at a fixed rate per kilowatt-hour (kWh) that is typically lower than your utility’s rate.

- Pros: Zero upfront cost, maintenance included, and payments are directly tied to the system’s performance (you only pay for power generated).

Cons: The rate per kWh often has an “escalator clause” (e.g., 1-3% annual increase), which can eat into long-term savings. Like a lease, you do not own the system or the incentives.

Maximizing Savings: How to Finance Solar Panels with Incentives and Rebates

A critical part of determining how to finance solar panels is incorporating the financial incentives available. These subsidies and credits can drastically reduce your net cost, making ownership more affordable.

The Federal Solar Investment Tax Credit (ITC)

The most significant incentive in the US is the Federal Solar ITC, also known as the Residential Clean Energy Credit. This credit allows homeowners who purchase (cash or loan) their solar system to deduct a percentage of the installation cost from their federal income taxes.

- Current Rate: The rate is currently 30% (as of 2024 and through 2032). This is a dollar-for-dollar reduction on your tax liability, making it an extremely powerful tool for affordability.

- Example: For a X30,000 system, the 30% ITC saves you X9,000 on your federal taxes. Your net cost drops to X21,000.

Crucial Note: You must own the system (via cash or loan) to claim the ITC. Leases and PPAs do not qualify the homeowner for this credit, as the solar provider claims it.

State and Local Incentives

In addition to the federal credit, many states, municipalities, and utility companies offer their own incentives. These can include:

- State Tax Credits or Rebates: Direct rebates or credits to further lower the cost.

- Performance-Based Incentives (PBIs) / Solar Renewable Energy Certificates (SRECs): In some markets, you can earn certificates for every megawatt-hour (MWh) of electricity your system generates, which can then be sold for cash.

- Property Tax Exemptions: Many states offer exemptions so that the increased value of your home from the solar installation is not added to your property tax assessment.

- Sales Tax Exemptions: Eliminating the sales tax on the solar equipment.

Always check the Database of State Incentives for Renewables & Efficiency (DSIRE) to see which incentives are available in your specific area.

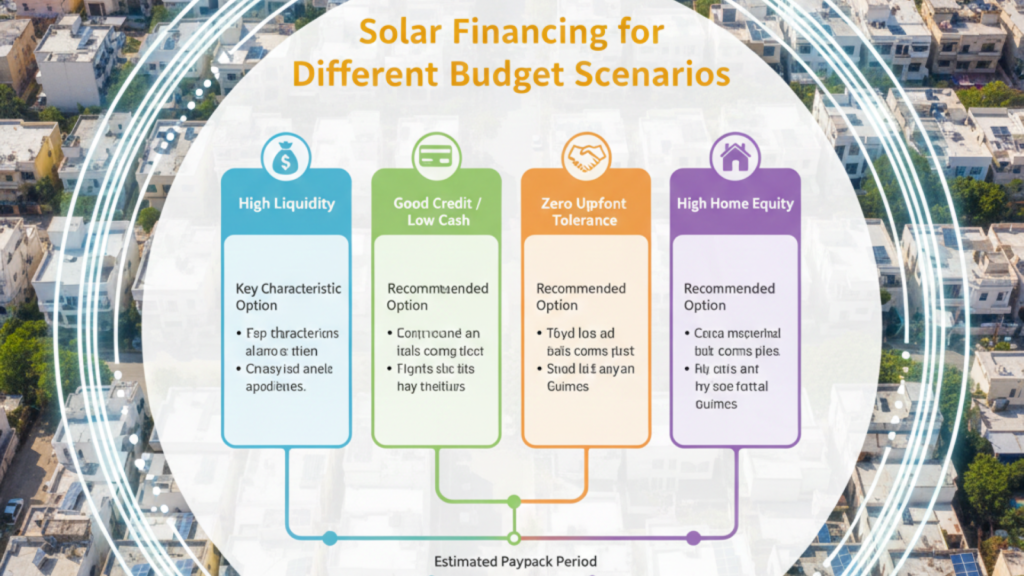

Solar Financing for Different Budget Scenarios: Choosing How to Finance Solar Panels

The best answer to how to finance solar panels depends heavily on your financial situation and priorities. Here is a breakdown of which option might suit you best:

| Your Budget Scenario | Your Primary Goal | Recommended Financing Option | Key Benefit |

| High Liquidity / High Tax Liability | Maximize Lifetime ROI and Savings | Cash Purchase | Highest ROI and claiming the full ITC immediately. |

| Good Credit / Low Available Cash | Ownership without Upfront Cost | Secured or Unsecured Solar Loan | Claiming the full ITC and owning the system for maximum long-term savings. |

| Strict Monthly Budget / Zero Upfront Tolerance | Lowest Immediate Out-of-Pocket Cost | Solar Lease or PPA | No initial investment and fixed or predictable lower monthly energy costs. |

| High Home Equity | Lowest Possible Interest Rate | Home Equity Loan (HEL) or HELOC | Very low interest, often tax-deductible interest payments. |

The Final Step: Finding the Best Solar Loan for You and How to Finance Solar Panels

If you decide that a solar loan is the right path, comparing offers is vital. Loan terms, interest rates, and fees vary widely between lenders.

Key Factors to Compare When Choosing a Solar Loan

- Interest Rate (APR): This is the most critical factor, as it determines your total cost over the life of the loan. Lower is always better.

- Loan Term: Shorter terms (10-15 years) mean higher monthly payments but less total interest paid. Longer terms (20-25 years) mean lower monthly payments but a higher total cost.

- Dealer Fees (or “Discount Points”): Some solar loans include a dealer fee, which is a percentage of the total loan amount. The dealer often pays this fee to the lender to “buy down” the interest rate to a lower rate advertised to the customer. This fee is often hidden in the overall system cost, so ask your installer for the cash price versus the financed price.

- Prepayment Penalties: Check if you can pay off the loan early without penalty. This is important if you plan to use your ITC refund to pay down a lump sum.

Conclusion: Making the Right Solar Financing Decision

The question of how to finance solar panels has many valid answers, but the core distinction is between ownership (Cash and Loans) and third-party ownership (Leases and PPAs).

For the vast majority of homeowners, purchasing the system through a Solar Loan is the best option. It eliminates the need for massive upfront capital while retaining all the benefits of ownership, including the lucrative 30% Federal ITC and maximum long-term savings.

Take the time to assess your cash availability, your credit score, and your long-term plans for your home. By understanding the intricacies of each option, you can confidently choose the right solar financing path that aligns with your financial goals and leads you to a brighter, more sustainable future.

Frequently Asked Questions (FAQ)

Q1: Is it better to lease or buy solar panels?

A: In almost all cases, buying (either with cash or a loan) is financially superior. Buying allows you to claim the 30% Federal ITC and maximizes your long-term savings. Leasing is only better if you have zero tolerance for upfront costs, have a very low credit score, or have a tax liability too small to benefit from the ITC.

Q2: How long is the payback period for a solar system?

A: The payback period (the time it takes for your cumulative energy savings to equal the initial cost) typically ranges from 6 to 9 years for homeowners who purchase their system. This period can be shorter if your local utility rates are high or if you take advantage of local incentives.

Q3: Does getting a solar loan affect my eligibility for the Federal ITC?

A: No. If you finance your solar panels through a loan, you are still considered the owner of the system, and you are fully eligible to claim the 30% Federal Investment Tax Credit (ITC).

Q4: What happens to my solar panels if I sell my house?

A:

- Owned System (Cash or Loan): The system is a home upgrade and typically increases your property value, making the home more attractive to buyers. You transfer ownership and the new owner gets free electricity.

- Leased/PPA System: The contract must be transferred to the new homeowner, who must meet the solar provider’s credit requirements. This can sometimes complicate or slow down the sale process.