The shift towards renewable energy is no longer just an environmental mandate—it’s a critical financial strategy for large enterprises, commercial complexes, and industrial players across India. Amidst steadily climbing commercial electricity tariffs and supportive government policies, investing in a 1 MW solar plant represents the optimal route to achieving substantial energy independence and cost reduction. This capacity point defines the MW scale solar plant sector, offering the perfect blend of operational efficiency and attractive tax benefits.

If you are preparing for a capital investment in a renewable asset, gaining a crystal-clear understanding of the 1 MW solar plant cost in India, the true value of incentives like Accelerated Depreciation (replacing direct subsidy), and the resulting robust ROI and payback period is essential. The following guide provides the comprehensive financial roadmap you need to make this strategic, long-term investment decision.

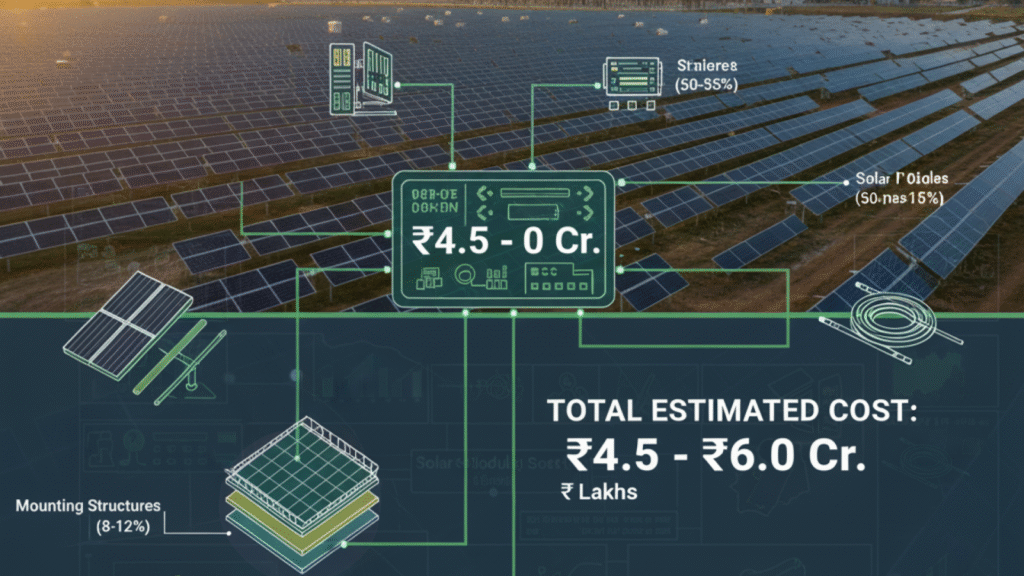

Unpacking the 1 MW Solar Plant Cost in India: A Detailed Breakdown

The cost of setting up a 1 MW solar power plant in India is not static; it is influenced by technology, location, and the type of installation (ground-mounted vs. rooftop). Generally, the estimated total project cost currently falls between ₹4.5 Crores and ₹6.0 Crores.

The Core Components: Capital Expenditure (CAPEX)

The total cost is predominantly driven by the key components and civil infrastructure. A transparent breakdown is crucial for investors:

| Component | Estimated Cost Range (₹ Lakhs) | Percentage of Total Cost | Key Cost Drivers |

| Solar PV Modules (Panels) | 250 – 300 | 50% – 55% | Panel type (Mono PERC, Bifacial, TOPCon) and Tier-1 brand selection. |

| Solar Inverters | 50 – 80 | 10% – 15% | Technology (String vs. Central Inverter) and efficiency rating. |

| Mounting Structures (BOS) | 40 – 60 | 8% – 12% | Fixed-Tilt vs. Single/Dual-Axis Tracking Systems. |

| Cables, Connectors, & AC/DC Systems | 30 – 50 | 6% – 10% | Quality of cables and safety/protection gear. |

| Land & Civil Work | 50 – 100 | 10% – 15% | Land purchase or lease cost (4-5 acres required) and site grading. |

| Installation, Commissioning, & Permits | 30 – 50 | 5% – 10% | EPC fees, regulatory clearances, and grid synchronization. |

| TOTAL ESTIMATED COST | 450 – 600 Lakhs | ~100% | (₹4.5 Cr. to ₹6.0 Cr.) |

Furthermore, the choice between a fixed-tilt structure and a tracking system for your MW scale solar plant can significantly alter the initial outlay, although trackers offer higher generation yield.

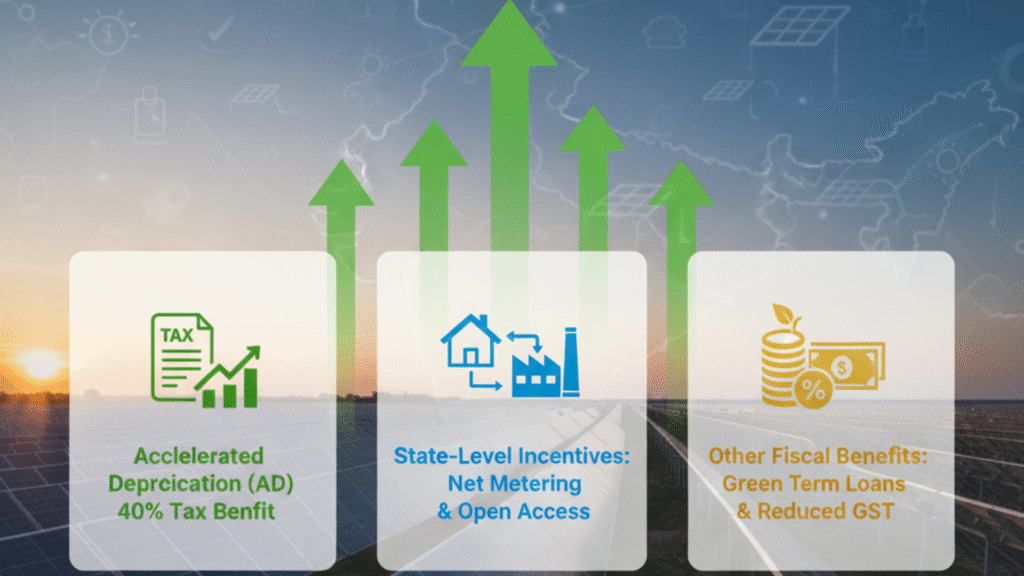

Demystifying Subsidies and Incentives for MW Scale Solar Plant Projects

For industrial and commercial MW scale solar plant investments, the focus shifts away from direct governmental subsidies (which are primarily for residential/small-scale) and towards powerful tax-based financial incentives. These incentives drastically improve the project’s economics.

Accelerated Depreciation (AD): India’s Biggest Tax Benefit

The cornerstone of financial viability for a commercial MW scale solar plant is the provision for Accelerated Depreciation (AD) under Section 32 of the Income Tax Act, 1961.

- The Benefit: Businesses are permitted to claim 40% depreciation on the capital cost of the solar asset in the very first year of operation. This is calculated on the Written Down Value (WDV) method.

- Impact on Payback: This tax deduction directly reduces the company’s taxable income, resulting in substantial tax savings. In many cases, this saving can reduce the effective project cost by 10-12% immediately, accelerating the payback period from 6–7 years down to 4–5 years.

- Example (Illustrative): If the plant cost is ₹5.0 Crores, an AD claim of 40% (₹2.0 Crores) significantly reduces the taxable profit, enhancing immediate cash flow.

In addition to Accelerated Depreciation, several other state-level policies play a pivotal role.

Operational Policies: Net Metering and Open Access

- Net Metering: This mechanism is key for rooftop MW scale solar plant projects. It allows any surplus electricity generated to be fed back into the grid, with the consumer receiving credits for the power exported. This essentially allows the solar plant to “run the meter backward,” maximizing the financial savings.

- Open Access: For large ground-mounted projects, Open Access allows a project owner to set up the plant in one location (e.g., a sunny state like Rajasthan) and transmit the power to their captive consumption unit (e.g., a factory in Maharashtra) via the state grid. This is a critical factor when designing a large MW scale solar plant.

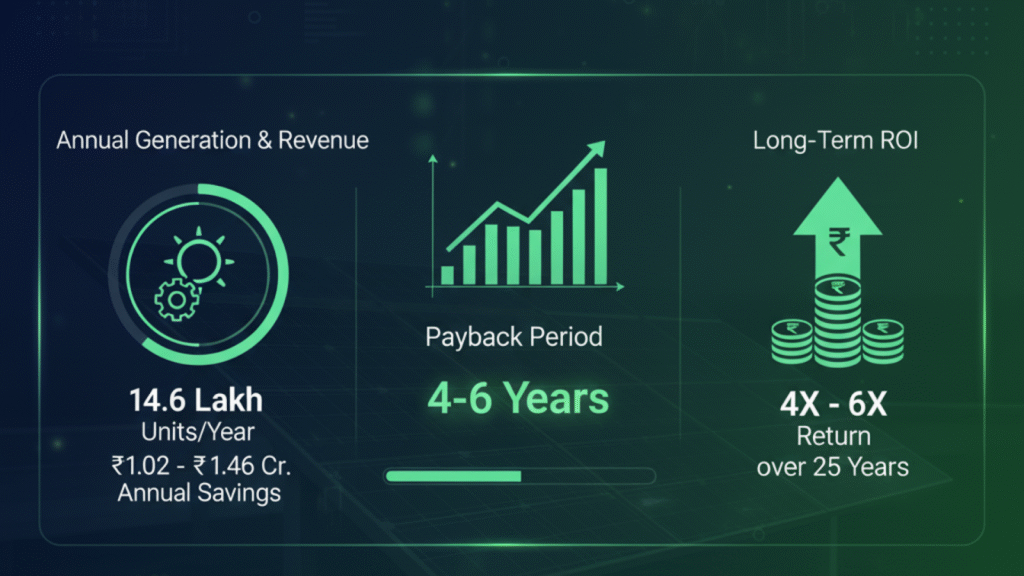

Calculating the ROI and Payback Period of Your 1 MW Solar Plant

The ultimate measure of a successful investment is the Return on Investment (ROI) and how quickly the initial capital is recovered. This calculation depends heavily on the amount of electricity generated and the commercial power tariff saved.

Annual Energy Generation Potential

Firstly, we must determine the generation capacity.

- A well-optimized 1 MW solar plant in India, given the excellent solar irradiance, can generate approximately 4,000 to 4,500 units (kWh) of electricity per day.

- Annual Output: This translates to a massive annual energy production of roughly 14.6 Lakh Units (kWh).

Revenue & Payback Projections

The financial returns are calculated based on the cost of electricity saved (for captive use) or the tariff at which power is sold (for independent power producers – IPPs).

| Financial Metric | Calculation/Details | Estimated Annual Value (₹) |

| Annual Revenue/Savings | 14.6 Lakh Units × (Commercial Tariff: ₹7 – ₹10/Unit) | ₹1.02 Cr. – ₹1.46 Cr. |

| Annual O&M (Operation & Maintenance) Cost | Typically 1% to 2% of CAPEX | ₹8 Lakh – ₹15 Lakh |

| Net Annual Cash Flow | Gross Revenue – O&M Cost | ₹94 Lakh – ₹1.31 Cr. |

- Given a high commercial tariff and the benefit of Accelerated Depreciation, the average payback period for a well-executed 1 MW solar plant in India is an impressive 4 to 6 years.

Long-Term ROI:

Furthermore, considering that solar panels have a performance warranty of 25 years, the electricity generated after the 6th year is essentially free. This leads to a substantial long-term Return on Investment (ROI) of 4x to 6x the original investment over the plant’s lifetime.

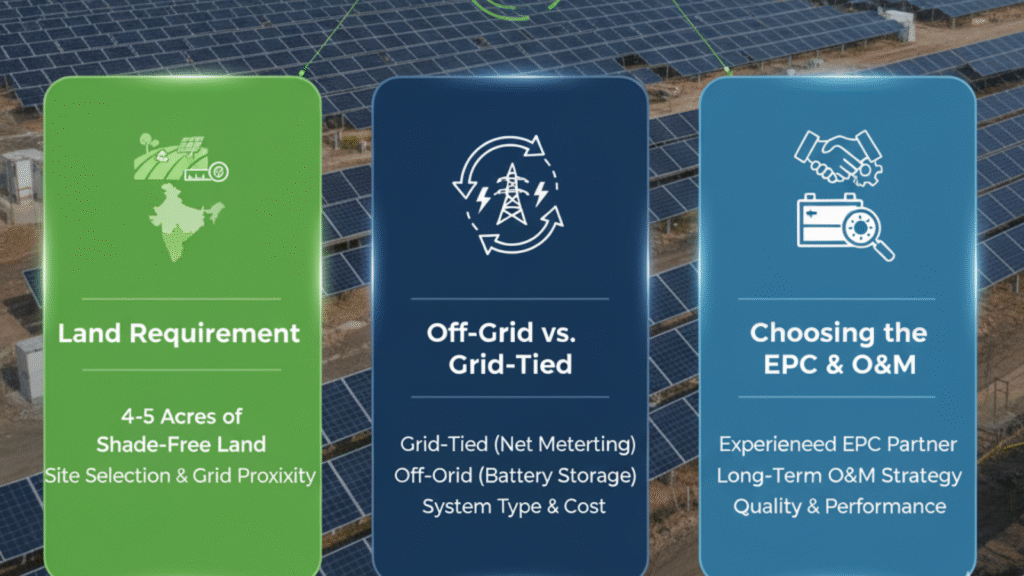

Key Execution Factors for Your MW Scale Solar Plant

Successful execution of a large-scale project requires meticulous planning, well beyond the financial spreadsheets.

Land and Infrastructure Requirement

Crucially, the site selected dictates much of the project cost and complexity.

- Land Area: A ground-mounted 1 MW solar plant requires approximately 4 to 5 acres of shade-free, flat land. Site selection is critical, prioritizing areas with high solar irradiance and easy proximity to a substation for grid connectivity.

- Grid Interconnection: The cost and time required for high-voltage grid interconnection (Substation and transmission lines) can be a significant variable, demanding early engagement with the relevant DISCOM (Distribution Company).

Partner Selection and O&M

Selecting a reliable EPC (Engineering, Procurement, and Construction) partner is arguably the most important decision. A good EPC ensures the use of Tier-1 components, optimal design, and smooth commissioning. Once operational, the O&M (Operation & Maintenance) strategy must be robust, often involving SCADA systems, automated cleaning, and timely inverter servicing to ensure the MW scale solar plant maintains its peak generation efficiency for 25 years.

Frequently Asked Questions (FAQ) for Your MW Scale Solar Plant Investment

Q1. How much land does a 1 MW solar plant typically require in India?

A. A ground-mounted 1 MW solar plant generally requires 4 to 5 acres of shade-free, flat land. However, this specific area can certainly vary. For example, panel efficiency directly influences space needs, and furthermore, the type of mounting structure (fixed versus tracking) is also a crucial factor.

Q2. Are direct government subsidies available for 1 MW commercial solar projects?

A. Direct capital subsidies do not typically apply to MW scale solar plant projects in India. Instead, the most valuable incentive is the 40% Accelerated Depreciation tax benefit. Consequently, this provision significantly reduces taxable income, thereby lowering the effective project cost for businesses.

Q3. What is the expected lifespan and long-term financial return (ROI) of a 1 MW solar plant?

A. A properly maintained MW scale solar plant is built for longevity, with solar panels typically carrying a performance warranty of 25 years. Beyond the initial 4-6 year payback period, the plant delivers virtually free electricity, leading to an impressive long-term ROI of 4X to 6X your initial investment over its lifetime.

Q4. How much electricity (in units or kWh) can a 1 MW solar plant generate annually in India?

A. Given India’s favorable solar irradiance, a well-optimized 1 MW solar plant can generate approximately 14.6 Lakh Units (kWh) of electricity per year. This figure is based on an average daily output of 4,000 to 4,500 units, providing substantial energy savings or revenue.

Q5. Which factors most significantly impact the total cost of an MW scale solar plant?

A. The overall capital expenditure (CAPEX) for an MW scale solar plant is predominantly influenced by two key factors. Firstly, PV modules (solar panels) constitute 50-55% of the total cost. Secondly, the cost and availability of suitable land are absolutely crucial. Additionally, technology choices, such as high-efficiency panels or solar trackers, also play a significant role in the final price point.

Conclusion: Powering India’s Future with MW Scale Solar Plant Investment

Ultimately, investing in a 1 MW solar plant in India is more than an environmental choice—it is a compelling financial strategy. With current market costs averaging ₹4.5 Crores to ₹6.0 Crores, the project is underpinned by strong government tax incentives, notably the 40% Accelerated Depreciation, which dramatically reduces the effective cost.

The result is a highly attractive financial model: a short payback period of 4 to 6 years, followed by decades of virtually free, reliable electricity. As commercial power tariffs continue to increase and the need for energy independence grows, the economic logic for deploying an MW scale solar plant becomes irrefutable. It is a proven pathway to cost control, enhanced sustainability, and robust, long-term ROI for any forward-looking business.